The Future of Bike Retail

How do you "Support Your Local Bike Shop" while also supporting retail innovators who deliver superior price and service? Is there something unethical about buying mail order? Is supporting the local shop charity or advocacy? I don't think so. My message to whiney bike shop owners is: don't complain, compete. The best among them are competing or, to put it more accurately, they have just begun to fight.

The irony is: if technology, in the form of the internet, has been a weapon used against the LBS, some of that same technology empowers the local bike shop (LBS) to fight back.

But not all of them are fighting back. Some local bike shops are going to fade away. But, since bicycles aren't going anywhere, new opportunities are going to crop up.

The way you get the goods you want will continue to evolve, and for the better. What you'll read below is my best prediction of what the retail landscape will resemble in 5 years, and probably sooner. By "below" I mean both what you'll read below as well as what you'll read over the rest of this week in multiple installments.

Crackazon

Let's talk about our Crackazon habits, and when I say "our" I include you and I — the consumers — along with the brands who make the products you buy, as well as the retailers in the middle who have decided that an Amazon "partnership" is in their interests.

Let's take a look at the world two years ago and the world as it is today.

During this scant two years, Amazon's the big winner and by Amazon I mean those of you who choose to buy using Amazon as a gateway, whether Amazon sells you the product or middles the transaction between you and an Amazon partner store.

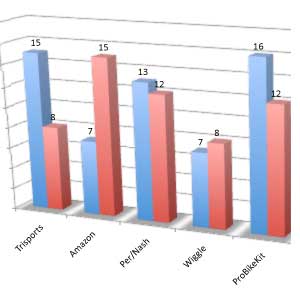

The British Invasion hit a speed bump. Pro Bike Kit has lost 25 percent of the head of steam it built up over the past half-decade — among Slowtwitchers — and Wiggle and Chain Reaction Cycling, while maybe picking up steam inside the UK or in Australia, remains small and flat inside the U.S. (again, limited to Slowtwitchers).

Nashbar has not increased its market share among Slowtwitchers, nor have any of the other upstarts like BikeTiresDirect. Traditional stalwarts like Trisports.com have seen their market share eaten into by Amazon, and when I ask Slowtwitchers who it is they're talking about when they choose "other" the consensus seems to be EBay partner stores.

The problem Amazon presents to the brands who sell to it are twofold: rather than a service provider who takes a slice of the revenue but leaves the great majority of the profit within the industry — like Visa or American Express — Amazon siphons that profit out of the industry whenever it buys from a vendor directly (more below on that). Second, its technology guarantees a race to the bottom on price. Let's talk about that now.

As you probably know, Amazon has amazing technology that allows it to scour the internet looking for the lowest available price on a product. Amazon presents that price to you, the customer. Should Amazon deal directly with a vendor, Amazon's price automatically shifts down to that point. That's great for the end user. However, there are knowable margins that allow retailers, like bike shops, to remain viable. If the price on every item is set not by the manufacturer, but by the lowest common price denominator found anywhere on the internet, it's clear that this is not going to end well for the lattice of rooftops that make up the brick and mortar network of retailers.

MAP Pricing

Is the dive to the price bottom what's best for consumers? Brands overwhelmingly believe their long term sustainability is in the maintenance of price. Hence the move toward a minimum advertised price (MAP) imposed on retailers. Brands are legally allowed to enforce how their products are advertised — this is not "price fixing." But retailers cannot seem to wean themselves off discounting and the current dodge around discounting is the coupon. If you wonder at the proliferation of the "coupon code at checkout," this is the MAP pricing end-around.

As for Amazon, it does not seem fazed by MAP pricing. Vendor after vendor to whom I spoke evinces frustration at the Amazon model. "We work with Amazon to maintain our MSRP," said 2XU's Fred Hernandez, its director of marketing. I hear that a lot. I hear it from almost every brand — the special effort that brand is making to make sure Amazon treats its products differently than everyone else's products. Geoff Shaffer, Hernandez' analog and contemporary at Pearl Izumi told me about the efforts his brand is making that we'll see executed going forward.

I asked 2XU's Hernandez, "Does this mean Amazon has agreed not to price match? If so, your brand would be the first I've heard of that has cracked that code."

"Like everybody else, we have our own ways of telling Amazon what they might do to protect MSRP," Hernandez said. "But in an admittal that his brand has no real power over Amazon's pricing, "Toward that goal they [Amazon] don't hinder, but they don't help. Sometimes I question the effort, but it's not Amazon, it's others [whose prices] Amazon matches."

"So, you spend your day chasing retailer after retailer who's fallen off the wagon and resorts to a discount off your suggested retail."

That seems about the size of it, and Hernandez rued that it's, "almost a disproportionate effort, but it's our view that if that's what it takes to maintain credibility with our specialty retailers, that's what we have to do. It's a daily battle. It's frustrating, it angers us, sometimes we'd like to throw our hands up."

Why, then, do brands sell to Amazon? In the case of 2XU, it's because Amazon represents the ability for that brand to expand its reach. Its compression wear is used now in major sports, like football, and it's making a big push into swimming. 2XU pays extra for an expanded pseudo website on Amazon during which 2XU makes its case for its products.

Hernandez thinks 2XU can, "ultimately build demand through our presence on Amazon. We're a young brand, not that well known, so, we look at it as spreading the gospel of 2XU, raising the profile of the product for our specialty." Rather than specialty stores building up a brand to the point where Amazon approaches that brand directly, Hernandez thinks it can work the other way around: that his brand's presence on Amazon is large-audience platform that will allow 2XU to grow beyond its current niche.

"Bad" Amazon

That established, the more usual model is for a retail store to "partner" with Amazon, using that robust portal to increase that retail store's reach. However, if 5, or 25, or 75 stores that all sell a single brand "teach" Amazon that a particular brand is hot, it's a virtual certainty that Amazon will approach that brand seeking to buy directly. So much for the retail "partnership." 2XU is not alone in selling directly to Amazon. Just about every brand in its competitive set does so.

And this — along with price erosion — is the other behavior in which Amazon engages that I believe is a cancer to a niche activity like cycling. Were Amazon simply a gateway, aggregating inventories held at the local level into a virtual national warehouse, there is very little about which one could complain. In this case Amazon would take a service fee to help brands, retailers, customers find out where the best match is made between sellers and buyers.

Once Amazon flips that switch, and decides to approach a brand directly, badly needed profit is sucked out of the bicycle retail "ecosystem." As Amazon flips that switch over and over, a retailer's best brands focus their gazes on Amazon, and that Amazon partner retail store is left to refocus on their lesser performing brands. Why Amazon's partner retailers continue to "teach" Amazon which brands to approach directly is God's own mystery.

"Good" Amazon

For all the calumnies one can heap on this retail juggernaut Amazon has transformed the landscape in unequivocally positive ways. For smaller brands, or brands with a lot of SKUs, Amazon aggregates inventories into a virtual warehouse, providing customers with one-stop shopping for a national (or international) look at what's available online per the product he seeks.

Amazon also impresses upon the retail landscape common standards for customer service and a return policy (would that a powerhouse race registration engine use its might to enforce a common race transfer policy!). If Amazon ensures a race to the bottom in price (short term good for the customer, long term problem for the industry) it ensures a race to the top in customer service.

Finally, as we've seen with the example of 2XU, a brand may choose Amazon's formidable readership to expand the reach of its narrative.

Bike Industry Fight-Back

Yes, our readers buy mail order. In fact, if you query them, as we do, we consistently find that Slowtwitchers buy online at a rate of 85 percent, that is, 85 percent of our readers buy some stuff online. This is tri-specific stuff we're talking about. Only 15 percent buy nothing online for use in their avocations of swim, bike and run.

However, if you query them further, you'll find that, all things equal — price being "all things" — they prefer to buy from a bike or other similar specialty store. But superior service cuts both ways. One Slowtwitcher wrote that he and his wife buy from their LBS, "if it is within 15% of the best price online." But one Slowtwitcher indicated he'd even pay slightly more for an Amazon product because of Amazon's superior service and return policy.

When we poll Slowtwitchers they choose LBS options that, in the aggregate, accrue to 70 percent. In other words, assuming the options were available to tailor the LBS service to our readers' needs, they'd prefer to buy from the LBS. Further, of the available options representing the other 30 percent, only 8 percent chose Amazon! In other words, for all of Amazon's impact on the retail landscape — good and bad — Amazon has not gained an overwhelming brand following.

Since the LBS has close to a 10-to-1 brand advantage over Amazon among our readers, how does the LBS leverage this affinity the triathlete has for him? Ironically, one piece of technology currently available to him is that which Amazon itself uses. In the next installment of this series we'll talk about that technology, and how retailers and brands are making use of it.