HIA Velo: The Future?

Systems and channels are what have interested and animated me lately. Not products. Products are new and then they’re old. But a system is transformative.

Amazon is not a product. It’s a system. Sabre Corporation provided airlines a real-time data-processing system for booking reservations starting in the 1960s. In 1996 Sabre birthed a spin-off, Travelocity.com, leveraging its ability toward a consumer-direct portal. The world (and the world’s travel agents, sadly) know how transformative that technology has been. Systems, pathways, channels, more than products will lead the changes in sporting goods and bicycles. (They don’t have to be systems that cut out a distribution channel, as Travelocity did, rather a system that increases freedom, choice, speed of delivery.)

Today I received a press release from HIA Velo, a new enterprise headquartered in Little Rock, Arkansas. This is the work and brainchild of Tony Karklins, whose previous success was bringing Orbea to the U.S. HIA Velo bought the assets of GURU out of auction, and these were chiefly a first-rate paint facility along with tools, fixtures, machinery, jigs for making bicycles out of all four frame materials GURU worked in: aluminum, steel, titanium and carbon. HIA Velo brought all this from Montreal to Little Rock.

HIA Velo also acquired key manufacturing people from GURU and – surprise, surprise – CyclArt from Vista, California. Jim and Susan Cunningham have been the dean of bike painters since the 1980s, and they painted a lot of bikes for me during my Quintana Roo days. I asked Tony Karklins if the Cunninghams are actually moving to Little Rock (not that there’s anything wrong with that!) and he said yes. I didn’t think you could blast them out of North San Diego County!

Then there are some other top-cabin bike brains Tony has gotten to move to Little Rock (Tony is hard to say no to).

HIA Velo is a U.S.-based manufacturing facility for bicycles. A handful of brands will be built there, beginning with Allied Cycle Works, a new brand that the company will launch. It will make road race bikes, tri bikes, mountain bikes, city bikes, whatever the market wants, just like any other full service bike company. It is looking now for its next brands, which might be home-grown, or acquisitions, or joint ventures.

So what? U.S.-made is nothing new; and bike brands are a dime a dozen. What’s transformative about this company? Three things.

First, Tony Karklins places great value on a system that I think is under appreciated: Trek’s Project One. When I ask Slowtwitchers whether they’d like to pay hundreds of dollars more for a bike the way they want it, or save hundreds of dollars by purchasing a complete bike spec’d the way the manufacturer decides, my readers are split down the middle. This the case, why is virtually the entire bike industry catering to half my readers’ preference; the other half of my readers not having their preference addressed at all? In my opinion, when Canyon arrives in the U.S. the feature that will make this brand a success is not deep price savings, rather the customer’s ability to get the bike with his or her choice of parts kit and the paint and the wheels and handlebars and power meter all at once, in the beginning, from the get-go.

Imagine a website, like Project One. In fact, Tony Karklins saw the power of this a decade ago and had it up and running for Orbea’s bikes. It was ahead of its time. Now is the right time.

Second, Tony understands that the Independent Bike Dealer (your LBS) is of critical importance, but the IBD of the 21st Century will not necessarily operate like IBD of the 20th Century. In my opinion, IBDs of the future will decide how they make their money; what investments in treasure and floor space they can devote to pre-season bike programs; and enterprising manufacturers will honor these decisions with programs that cater to stocking- and non-stocking dealers; with margins scaled to fit the IBD's risk comfort. Indeed, it’s hard to force a large pre-season on a dealer if the whole point of the Little Rock facility is to provide a Project One type sales experience.

Third, Tony also realizes that the bike market does not include $12,000 bikes. Or even $8,000 bikes. While these bikes are for sale, very few of them get sold. The operative, functional, real-world market for complete pro bikes starts at $2,500 and ends at $6,500.

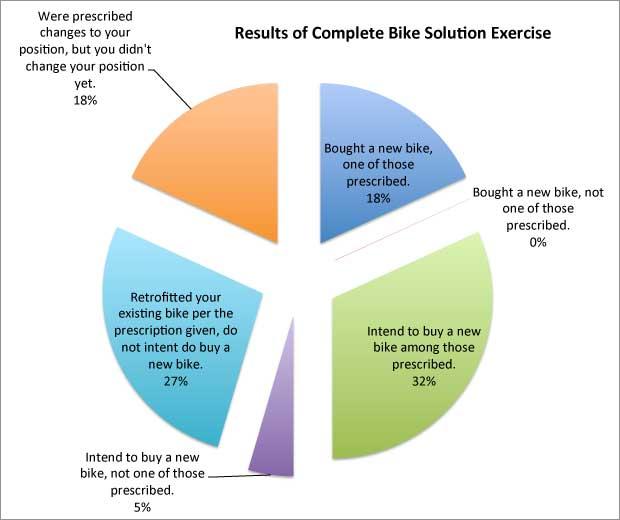

HIA Velo is not going to be a custom bike maker, as GURU was. The goal is to make production bikes, but with stateside paint and assembly, which means paint and assembly that doesn’t need to take place until the consumer decides what paint and parts he wants. Further, for those shops that are very good at complete bike prescribing (i.e., for those shops that understand the F.I.S.T. fit processes we developed and teach here), a bike can be shipped to a shop, or drop-shipped directly to a consumer, set up precisely to match a rider’s fit coordinates.

Will HIA Velo be a success? Will it disrupt and transform the U.S. bike market? I don’t know. Honestly, it’s not what HIA Velo is, but what it could be that interests me. I do believe that U.S.-based bike manufacturing is a near-term reality. So much of a monocoque bike these days are soft costs (development, testing, engineering, mold making) that the amortized per-unit cost of a carbon frameset contains less and less semi-skilled labor. You will see frame manufacturing begin to return to the U.S. very soon.

Whether HIA Velo becomes a force in the industry is dependent on the product it makes. But, this company is not starting its life tied to processes, economies, systems developed in the last half of the 20th Century. It has no sales and distribution structure it must renounce. It has the freedom a lot of flagship bike brands wish they had, and it understands the value of this.

Start the discussion at slowtwitch.northend.network