Kona Bike Survey: groupkits and aero wheels

Having previously dispensed with bike brands, our analysis of Kona equipment turns to certain other items used on bikes during the 2007 Hawaiian Ironman.

Next to the frame itself, the most wallet-lightening options are race wheels, groupsets and perhaps the power meters. The latter are still relatively few in number, though the population of SRMs, Powertaps and Ergomos is growing at a rapid rate.

As to groupsets, it's tenfold Shimano over Campagnolo, 1521 to 153. Entering the fray is SRAM, with 20 gruppos. Why does Shimano have such a stranglehold? Because tri bikes are almost entirely purchased as complete bikes, not as frames and kits. Campagnolo simply does not care about placing its groups as original equipment on bikes. Its interest is entirely in the aftermarket.

But what about SRAM? Within two years SRAM will overtake Campy for the second position, for several reasons. First, SRAM does care about OE. Second, SRAM actually offers a more fleshed-out OE groupkit than Shimano does, if you think about it. Shimano has a bar-end shifter that's approaching its twentieth year without a meaningful change, versus SRAM's newly engineered set. Shimano inexplicably still does not have a brake lever for tri and TT bikes, while SRAM may now offer the best one out there. And SRAM is just crossing "t"s and dotting "i"s in its acquisition of Zipp.

If you handicap this thing like they do in football, and you compare drivetrains to drivetrains, brakes to brakes, wheels to wheels, well, SRAM starts to look pretty good in these head-to-head match-ups. Of course, SRAM can't price its components as a group. SRAM accused Shimano of just those sorts of predatory pricing policies during the 1990s, and Shimano had to adjust its pricing habits in a way that benefited SRAM. Now the shoe will be on the other foot, and don't think Shimano's lawyers won't lay in the tall grass for evidence of the same from SRAM.

All that established, SRAM will have a robust narrative when its OE salesmen talk to buyers from Cervelo, Kuota, Felt — many of which Shimano treated with less than the intended respect back when their principals were young whippersnappers heading start-up companies.

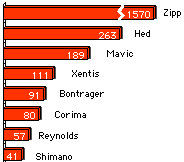

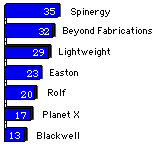

There is no category in this race where a manufacturer has a greater stranglehold than in the category of race wheels. But let's just be honest here. How many of Zipp users bought their wheels because they were convinced a Zipp 808 was faster than a HED 3? How many retailers sold Zipp wheels convinced of this? Or is it more about Zipp's dynamic sales and marketing abilities?

Why is this germane? Let's revisit SRAM's acquisition of Zipp. And let's look at this against the backdrop of companies like Mavic, Shimano, and Campagnolo, all of which have had plenty of opportunities to out-spend, out-invent, out-sponsor, out-distribute and out-advertise both Zipp and Hed in the category of wheels. Yet these two American wheel companies dominate the other three.

Against that backdrop, what is it that SRAM wants and needs from Zipp? The one thing SRAM lacks is the original equipment wheel. Right now it says to the industry: Here are our shift systems, our brakes, our cranks, cassettes, chains and… our hubs. That doesn't work in today's world. So it needs wheels, and it needs those wheels all the way down to the "Shimano 105" level.

You don't think Zipp is the brand name going on those wheels? If you don't, you're dreaming. What will that mean to Zipp at the other end — the high end, the $2000 per pair end? Zipp is not going to suffer as a brand. It will prosper. But its prosperity may be very much like Bontrager's — it may succeed wonderfully at the Shimano R550 and Mavic Ksyrium level, only to lose its cultural bearings. This year may mark Zipp's high water mark at this race.