Bike Brands and Sponsored Pros in Kona

There were 95 bikes that made it onto the island and into the pro transition area at the Hawaiian IRONMAN World Championships, which is where I counted these bikes and the equipment on them. These pro bikes make up about 2 percent of all the bikes that were in the race.

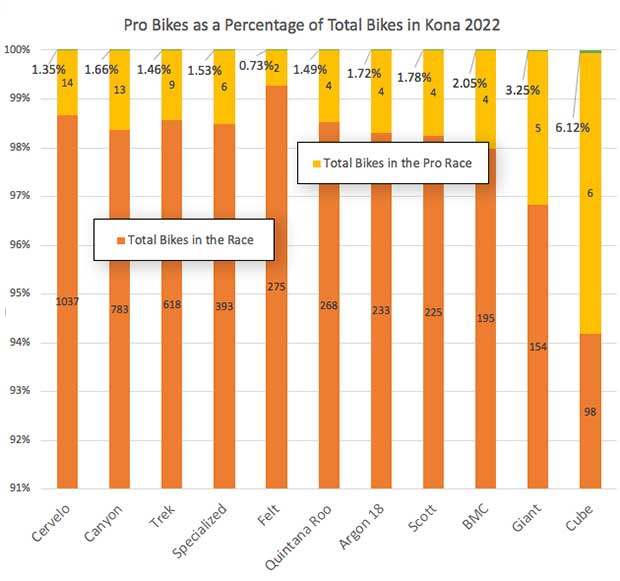

My intention is to show you the total number of bikes each major brand had in the pro field, and the percentage of pro bikes versus total bikes each of these major brands had in the race. Let's see if we can determine whether the brands are over- or under-represented in the pro field. But with this caveat: I stipulate for the Kona race that for most brands there's a close correlation between sponsored riders and bikes in the pro field. There's error in that assumption and I don't know how large that error is. And with that…

I’ve heard the cynical claim over the years that certain bike brands try to buy their way up the Kona bike count. (You can see the full equipment count over at Triathlete Magazine.) That may very rarely be true in other product categories but not for bikes. The numbers don’t support that. Most of the leading brands had a penetration in the pro racks closer to 1.5% of their brand’s race totals.

The top brands appear remarkably congruent in how they approach sponsorship. It is my guess that the brands currently selling the most bikes to triathletes right now – especially in North America – are Cervelo and Canyon (1st and 2nd, in no particular order), then Trek and Quintana Roo (3rd and 4th, in no particular order), with Argon 18 not far behind (if behind). For the purpose of this analysis let’s also consider the following brands for these reasons: Felt, because it still sits 5th in the total number of bikes in Kona; Giant, because of its reach in both Australia and Europe; and then Scott, Cube, BMC because of their worldwide reach but notably their strength in Europe.

In the case of each of the 4 brands that I think are selling the most tri bikes in North America right now – Cervelo, Canyon, Trek, Quintana Roo – the brand with the highest number of pros in the race, Cervelo, actually has the lowest percentage of its total Kona bikes ridden by pros. Only 1.35% of all the Cervelos in Kona were ridden by pros. Of these 4 brands the highest percentage belongs to Canyon at 1.66%. Those percentages are really close. If you were to take out 1 of Canyon’s 13 bikes ridden by the pros in Kona this year their percentage falls to 1.53%. Quintana Roo and Trek were almost at 1.5% dead on.

The low is Felt, with only .73% of all the bikes in the race ridden by pros. I counted only a pair of Felt IA 2.0 bikes ridden by pros in the race, 1 by Daniela Ryf and 1 by Braden Currie., each a Felt IA 2.0. My sense is that Felt’s total of 275 bikes in Kona largely consists of legacy bikes, which is my term for bikes not purchased recently but still show up in Kona. I don’t know for sure. I note that Felt in recent years has supplied the pier of about 8 percent of its total bikes but this year is down to 5.7%. Meanwhile Quintana Roo’s share has typically been around 5% and has risen this year to 5.6%. This change, and the way our readers answer our polling on this, is why I think the 4 brands I list above are probably the current leaders in North American tri bike sales (with Argon 18 right there with Trek and QR). Most of the other significant brands did not have a change of more than 1 percent in either direction except… Canyon! Which doubled its penetration in this race and Canyon bikes now make up about 16% of the race.

The German brand Cube looks like it has a lot of pros in the race, and it does as a percentage of its total penetration in the race (6%). But this brand has gone from having total bikes on the Kona pier in the teens or low twenties to about a hundred bikes in this year’s Kona races and, yes, the number of bikes in the race has doubled. But Cube has quadrupled or quintupled its total number of bikes on the pier in Kona. It didn’t get there by padding its numbers with pros. It only had 6 bikes in the pro race. It’s investing.

Remember that for all these brands I’m counting the number or bikes brands have in the pro racks, not the number of athletes these companies sponsor. I believe I only saw 1 each Cube C:68 with disc brakes in the race: ridden by Lucy Charles-Barclay and Florian Angert. The other Cube bikes were all the rim brake version. I don’t know if those athletes are sponsored by Cube or not. I do know that quite a few pros had no deal with any bike brand and those no-deal bikes consisted of Specialized, Trek, Cervelo and other brands.

Of the 4 brands with the most bikes in the race Cervelo had the most male-centric breakdown, with 10 men and 4 women. But I suspect that as many as 4 or 5 of those 10 men had no deal with Cervelo. When I count the athletes I know Cervelo considers its supported team, it’s very close to an even male/female split.

Start the discussion at slowtwitch.northend.network