Escape from Alcatraz 2.0

High prices are a hallmark of the City By the Bay. The recent HBO documentary "San Francisco 2.0" showed how tech money is transforming the Bay Area economy. The skateboarding dot-com insta-rich are pricing out the culture that, for the last three-quarters of a century, defined and shaped San Francisco.

But even those hardened to the cost of life in the Bay Area reacted with "shock" and "disbelief," calling the new fee to enter the Escape from Alcatraz Triathlon "insane". San Franciscans were apprised of the increase from $450 to $750 not on Slowtwitch, but on their local ABC and NBC television news. They read about it on SFGate, the Hearst-owned sister site of the San Francisco Chronicle. Even Fortune Magazine covered it.

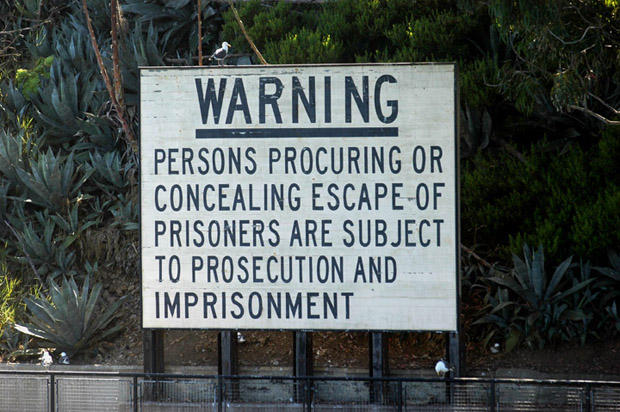

Escape's own Facebook page was wallpapered with outrage. The Slowtwitch Reader Forum lit up. The race's owner, IMG, has few social media supporters. Is there any defensible explanation for this increase, beyond charging what the market will bear? Slowtwitch asked those in a position to know, to see if IMG is simply price gouging or whether there are facts that justify an increase of this magnitude.

Those attached to the production of this race were extremely careful in their comments. Typical were reticent statements or answers only provided as background; quotes that could not be attributed, or were carefully wordsmithed; or no comment at all. The skin sensitivity was extreme, even more so than after the swim death in the 2013 Escape from Alcatraz race. The president of the Golden Gate Triathlon Club, Sam Gager, appeared livid while appearing on news shows, decrying a "lack of transparency," after the race produced a very slim explanation for the increase, citing a need to "maintain the integrity of competition and safety of all involved."

The race organization's statement could lead the reader to think the increase was scaled to meet an increase in safety costs. The new fee means the race will bring in an extra $500,000 or more in revenue if you simply multiply $300 times 1700 contestants (the race accepts 2000 entrants, but some are pros and some are holdovers who couldn't race last year – Escape has a rare generous policy for prior-year hard luck cases). Was there a corresponding increase in race costs? I couldn't find it.

Escape is a 35-year-old event, and, like other triathlons that old, it was conceived in love and it grew feeding off pure energy. None of the races back then were designed to be equities. Sports conglomerate IMG bought Escape in 1998 and has been running it since then. Escape is part of IMG's portfolio of triathlons, not the biggest race, but it is the flagship. It's also not one of the richest races and, since Escape now is an equity, this has become a problem.

The custodian of this race, since 2004, has been James Leitz. He's a friend of mine and a good man. He and I could not find common ground on attributable quotes, and accordingly, I've got few-to-no quotes I'm comfortable writing. But I do have a sense of the pincer the organization finds itself in.

To be clear, on a percentage basis this is not an unprecedented entry fee increase for this race. In 2008 the fee went from $189 to $350. The fee to enter has climbed much more slowly since then and Escape's production costs outran the fee increases since 2008. Production costs? San Francisco is not remotely like any other city except, maybe, New York City.

One veteran of San Francisco race production called the park and city fees, "Very expensive. Staggeringly expensive." Golden Gate Park may be the "richest piece of real estate on the West Coast" to rent. If the race doesn't want to pay the steep rental fee there are several other takers waiting in line.

There are at least six parks, properties, and agencies involved in this race. It's not just Golden Gate Park where, if you put a weekend music concert there, the fees might outstrip Escape's entire revenues. There is also Marina Green, Chrissy Field, and shutting down the Presidio, and that doesn't even include the costs incurred for the bike leg. None of this touches the money needed to produce the race itself, renting the ferry, and the general costs of race production and hospitality.

Beyond this there is a substantial production cost for an Escape TV show that helps keep this a bucket list race. The TV show was represented to me not as a money maker but an expense suck. Like Ironman's Kona TV show, it's really an advertisement for IMG's race portfolio and IMG draws a line directly between the popularity of Escape and the filling up of races like the one it produces in Beijing. If the rest of IMG's portfolio benefits from Escape, should Escape's income statement absorb everything on the expense column? I don't know, but it does.

There have been other revenue hits. Escape's raffle – your first hurdle to entering Escape – went from paid to unpaid following the U.S. Attorney saying that Ironman's lottery was improper. That dropped from Escape's top line a low-six figure revenue stream that had no offsetting expense.

Also, Escape has not had a title sponsor since 2008, when Accenture went out. Mr. Leitz points to the difficulty in finding companies that want to sponsor a 1-off local property, and that's true. The Wildflower Triathlon, which used to have no trouble finding a title sponsor, now struggles to find a title. Still, this is head-scratching, because matching Fortune 500 companies to brand-enhancing properties is what IMG does. That's its day job.

Escape has had a tough recent run with the canceling of a paid chance at entry and with no title sponsor. Via this price increase, the contestants basically are the title sponsor. Many, like Mr. Gager, feel that Escape's producers are opaque in their explanation. It might be that the most artful messaging would fail to assuage the anger of Escape's contestants and volunteers. Nevertheless, Escape's business was sick. The entry fee increase is drastic medicine and will either kill it or heal it.