What’s the deal between Ironman and Life Time Fitness?

Announced at the TBI Conference this week was the rebranding of several races reminding me of a baseball card swap. Soma and Bend, former Life Time (or Life Time Fitness branded "Leadman") races will henceforth be Ironman branded. Soma will become a 70.3, Bend will likely become a 70.3 (rather than a full) and will be so-branded in 2016. Addressing the Conference were Ironman's Andrew Messick (right) and Life Time Fitness head of events Kimo Seymour. Slides below were among those presented to Conference attendees.

One takeaway is obvious: Ironman realizes its brand leverages down to 70.3 and no further. Life Time admits its brand leverages up to Olympic distance and no higher. Smart. This signals the end of the 5i50, even if that is unannounced. I'm not writing this because it's a stated fact, rather it's the obvious conclusion. But then some of us knew in 2011 that the 5i50 was a bridge too far and it just needed its contracts to run out; then it would be laid to rest in an unmarked grave.

Life Time's CEO, Bahram Akradi, an avid triathlete himself, will explain his interest in the events arm of his business to anyone who cares to listen. While only a fraction of all Life Time's customers participate in all its events (indoor and outdoor triathlons, footraces, and cycling events) its customer retention rates are much higher when those customers participate in these events. When I wrote about this in 2012 I estimated more than 100,000 discrete registrations per year in Life Time's events. That certainly has increased between then and now.

So you have it two ways: Existing Life Time customers tend to retain and re-up when they are also event participants; event participants who are not Life Time members are subjected to a club outreach at these outside events.

This dynamic is probably optimized at the short course level and Life Time obviously now realizes that. But this deep tie, down to the sinew and capillary, with Ironman means those Life Time members who are hyper-goal-oriented have access to a grand aspiration.

Here's a data point, I don't know if this is valid, but it's intriguing to me. About 1 in 6 club members are "non-access" members, who pay monthly to be a part of Life Time Fitness without going to a club or, I presume, enjoying much if anything in in-club privileges. This is a huge number of people. By keeping some form of membership alive they reserve the right to reanimate their club membership (maybe they're temporarily living and working where there is no club; maybe they're just taking a club hiatus). It seems to me that granting additional out-of-club benefits and opportunities to these folks both keeps the string attached; and there might eventually be a kind of membership available for Life Time members who are never able to enjoy the benefits of a club – who might never live proximate to a club. If the adding of events, and coaching and training for these events, to its portfolio of offerings was simply a strategic initiative aimed toward these non-access members, it might have value there alone.

Ironman. What's it getting? Access to close to 2 million club and non-access members who are regularly exhorted and urged to do a triathlon, if even a very short, in-club triathlon (everybody starts somewhere). Bear in mind the indoor tris are co-branded and there is at least one Kona slot devoted to this program! (More on the indoor triathlons below.)

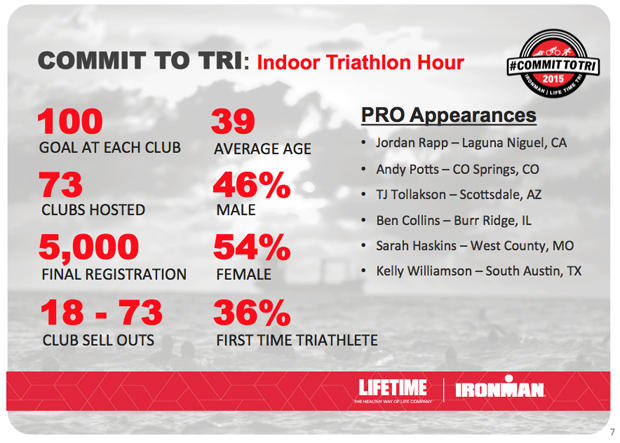

Both brands are engaged in an initiative called "Commit to Tri", but it means something different to each brand. To Ironman it means grabbing lapsed triathletes and giving them a reason to recommit. To Life Time it means grabbing non-triathletes and shunting them into a process. Its "Indoor Triathlon Hour" is an Ironman/Life Time co-brand. It's pretty interesting. It's like the hour record in that the metric for success is distance. You spend 10 minutes in the pool; 30 minutes on a spin bike outfitted with a power meter; 20 minutes on a treadmill. Longest distance covered wins. You get a 10-minute transition period. I like it. I'd like to do one.

So far, so good. The brands are doing more than ceding distance primacy to each other; and they're doing more than cross-marketing and promoting.

Last year the announcement was made. Life Time and Ironman are getting together to form a ranking program. Additionally, Ironman announced its own coaching program. These were probably not meant as shots across the bow aimed at USA Triathlon, but the shots were heard in Colorado Springs anyway. Coaching certification and training has been a key initiative not just of USAT but of all national federations across sports.

But USAT's coaching programs have been mainly geared toward Olympic development and youth. Life Time and Ironman have different interests. They are after the adult athlete who isn't interested in racing anything even remotely attached to the Olympic movement.

Rankings? That's a little closer to home. USA Triathlon's revenue stream is overwhelmingly membership-based. They sell memberships. Either 1-day or annual. What they really want are annual memberships, because these tend to be sticky. It's sticky, reliable money. Why would someone buy an annual membership? Some folks at USAT have tried to peddle the idea that all the annual members just like the idea of being members. The ancillary benefits received. I polled this, and 5.5 percent of 600-plus respondents said yes, they would be annual members even if there was no insurance or sanctioning financial incentive. The other 94.5 percent say they're annual members only because it's cheaper than buying a bunch of 1-days.

But that's not entirely fair to USAT. There are 5 bona fide, no-bull, reasons to be USAT annual members: 1) you're participating in enough races than an annual membership is cheaper than buying a bunch of 1-day memberships: 2) you want to participate in Nationals; 3) you want to go to Worlds; 4) you want to vote in a USAT election; 5) you want to be eligible for rankings.

Reason #1 is the biggie. But I think the ranking thing is also pretty big. If the Life Time / Ironman ranking system becomes the important system, this is a potential revenue hit for USAT.

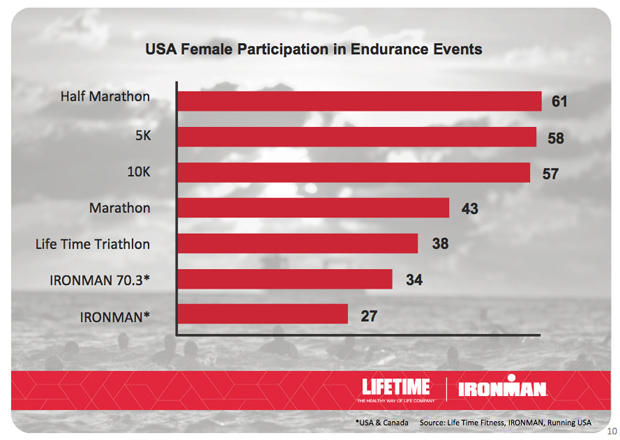

Here's an interesting set of stats. Ironman's customers are 27 percent female for its full-distance races. It's 34 percent for 70.3. Life Time's customers are 38 percent female for its outdoor triathlons. But its indoor Commit to Tri registrants (5000 least year, pushing for 10,000 this year) are 54 percent female. This is in line with footracing, where women make up the majority of registrants.

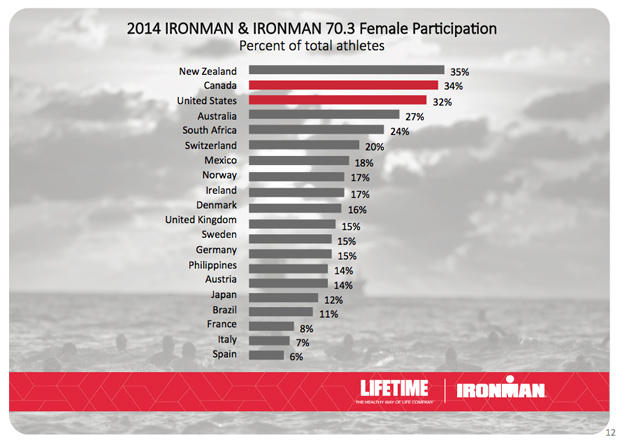

America is way ahead of the rest of the world in female participation in endurance sports and you can see it in Ironman's own stats. Only in Canada and New Zealand are there more female customers, on a percentage basis, than in the U.S. While it might seem that 32 percent female is a low number (that's the customer breakout for Ironman in the U.S.) it's in the 20s, teens or single digits everywhere else in the world excepting Canada and NZ.

Still, 32 percent is a low number when you consider that half-marathon registrants in the U.S. are something like 60 percent female. Life Time and Ironman see women as the lowest of the low-hanging fruit and I agree. Women overwhelmingly just want to be asked to participate. If you ask, and present a rational and safe pathway to participation, they'll say yes.

Is Life Time going to buy Ironman?

What follows is wild speculation on my part, please read as such.

The answer is, I don't know. I believe Bahram Akradi would love to acquire Ironman. If it was just up to him I think it would already be done. But he's got shareholders. His is a public company. The genius of his events division is that it's a very large marketing platform that makes its own money. As long as a case can be made for an obvious and compelling tie between events and club revenues what beats a self-funding marketing presence? What would it cost to blanket downtown Chicago for several days with huge LIFE TIME FITNESS banners all over the city center? What's wrong with getting that not only for no-charge, but via an initiative that makes you money? So what if the initiative even lost a little money? What would that exposure cost you if you just sponsored it?

But purchasing Ironman would be a big bite. It's not like buying the Chicago Triathlon. The purchase price of Ironman would probably represent a fourth or fifth of Life Time Fitness's market cap. It would bring Life Time's annual revenues from $1.3 billion to $1.5 billion. It would make Life Time's events segment more than just a footnote on annual statements and conference calls.

To me it all tastes and feels like a presidential executive action. I question whether Life Time's BoD would allow a purchase of Ironman right now, so, absent the "Congressional" approval to make that purchase Mr. Akradi is doing what he can do: forging a very obvious tie with Ironman and extracting every leverage and benefit he can get out of it. If it works; if it yields obvious fruit; if everyone benefits; then it's ammo in his gun at each successive board meeting where events is on the agenda.

Consider this: Based on the Boulder Peak announcement earlier this week, Ironman will own the Boulder Peak 70.3 while Life Time will own the Boulder Peak Sprint. Are these not hosted on the same day, same venue, same transition area? I have never heard of two races, owned by two companies, hosted and held at the same venue, same day, concurrently. If this is really what's going to happen going forward you can't tangle your brands together more than this.

Can Ironman – that is, can Providence Equity Partners – wait for Life Time to get around to buying the company? If not, will the eventual purchaser of Ironman be happy with a relationship with another brand that where each brand hyper-activates and leverages the other? I don't know. Ironman has been courting new prospective owners. This is no secret. Providence's ownership of Ironman is nearing the end of its cycle. I wrote about the logical suspects when covering Ironman's recapitalization. No doubt after this is published I'll get emails from those in private equity who are more in the know than I, and can give me a progress report.

Bottom line, Andrew Messick's tie-ins with Life Time are textbook leveraging done right. It's just expertly done. He either acts as if a purchase by Life Time is a fait accompli, or he acts as if he needs to grow his business without consideration for who the eventual owner of Ironman is. The only risk I see is if this strong tie to Life Time forecloses on an opportunity with a strong prospective suitor.

Either way, both Life Time and Ironman are acting as if they can't wait for anyone else to grow the sport and they're going to hoist the sport on their collective shoulders and grow it by themselves. I have small reservations about this which I'll bring up in a future installment but, in general, that's an ethic I can support.