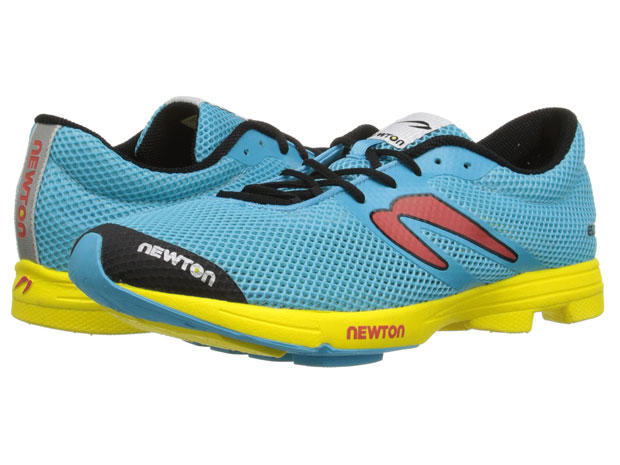

The New Look Newton

A case could be made that there are two companies triathlon built: Newton Running and Hoka One One. No footwear company grows large selling only to triathletes any more than selling only to trail or ultradistance runners, but both these companies tried to squeeze through the window of triathlon into mass participation running. Hoka slid through. Newton is still wedged between the sash and the frame.

There’s news to report. Newton Running’s co-founder, managing shareholder and one-time CEO, Jerry Lee, is back in the saddle. The real estate developer-by-trade left Newton’s day-to-day in 2015 but has resumed the CEO role. I asked Mr. Lee yesterday, “Who now owns the company?"

“Myself and a couple other investors.” I asked about Fireman Capital, the investment fund headed by Paul Fireman, the man who built Reebok. Fireman Capital famously invested close to $20 million in Newton in 2011 according to contemporaneous reporting. Fireman Capital, "sold their interest to new investors about a week ago,” said Mr. Lee.

The other big news is that Danny Abshire, the brand’s muse, its Old Testament prophet, is out. “Before Fireman was bought out, we had a store on Pearl Street in Boulder,” said Mr. Lee. “As you know brick & mortar are tough these days. I was not a part of the company at that time, a shareholder but not involved with management. When they closed that store, Danny took a look at [the landsape] and decided that if the store’s not there they [Danny and his wife Jennifer] are going to step back. It was a long haul, they just wanted a deep breath.”

I had two questions for Jerry Lee (pictured above).

Does Newton Stand By its Original Technical Premise?

Are the design imperatives and technical themes changing in the new-look Newton? It was the first popular low-drop shoe; is it still wedded to drops in the 3mm to 6mm range? And, Newton has always been suspicious of forefoot cushion interrupting the communication between the road and the nerves in the forefoot. This runs counter to some of the trends today, with Nike’s Flyknit, with Hoka, with some of Saucony’s and New Balance's shoes, that do not eschew forefoot cushion. With Danny Abshire gone, will Newton still adhere to Newton’s historical doctinal rigor?

"We founded the company based on that 3mm to 6mm heel to toe drop,” Mr. Lee said. “It will be continued on; it is our golden rule. It is still our belief that barefoot running is the natural way. When your foot strikes the ground you have that communication; part of our tech is our biomechanical plate that sits below the forefoot. Reducing the impact is important; damping is important; we also believe that plate provides the communication under the foot – the foot still senses something under there. With Barefoot you run very lightly; that’s the whole premise; we believe in reducing impact while we tell your foot it's striking the ground.

What Sales Channels Will You Value?

Newton, and the retailers who sell its shoes, tell roughly the same story but from a different perspective. “Specialty retailers have hit their bumps,” said Mr. Lee, "but we still believe in those retailers. They are still a very valuable force in the running community, but we are going to concentrate on the sellers versus the carriers.”

I spoke to a number of retailers who carry Newtons in their stores, one of whom is Cid Cardoso, Jr., owner of Inside Out Sports in metro-Raleigh, North Carolina. Mr. Cardoso is still a Newton believer. “Newton went from being a significant brand to where folks inside my company said, 'We don’t need them.' But not me. What I like about Newton is that it’s conceptually different. You can talk about it; it’s not just another shoe on the wall. It’s nice to have one where I can say, 'Try this.' There is space for Newton.”

But Mr. Cardoso says it was Newton that created the problem of “sellers” versus “carriers”. "They were opening everyone who’d fill out a credit app.”

Still, Mr. Cardoso is glad that Mr. Lee recognizes the need to trim its list of retailers. "If that’s what he’s saying now that gives me another reason to wait and see. You don’t need 16 retailers in Raleigh. You need 2 or 3.”

One other sales channel problem, according to many retailers, is that Newton was conflicted about whether to sell its shoes through retailers or direct-to-consumer. “At the same time they want to support the retailers they wanted to go online and sell the Gravity 4 at 30 percent off before they authorized the retailers to sell at 30 percent. Their marketing people were not driven to sell through the retailers, but to see how many they could online.”

This was a complaint I heard from a number of retailers. Still, specialty run stores accuse many or most brands of a cynical process of selling “old” editions and colorways online at a discount while the shoe is still an in-line seller at run specialty.

Newton also over-expanded, say retailers, in its breadth of models. "We don’t have space on the wall for 12 Newton shoes,” said Mr. Cardoso. "We have room for the Fate, Kismet, Gravity and Motion. They went too broad. They couldn’t deliver a lot of them.”

Trishop in Plano, Texas, is another Newton retailer and the opinions of it’s owner, Trent Nix, mirror Mr. Cardoso's. "Newton was on the forefront of the natural running craze and it was good while it lasted. And then the market caught up with them.” Mr. Nix sells a lot of Hoka these days, as well as On Running, brands that have bit into Newton’s specialty niche. Like Mr. Cardoso, he has trimmed the space Newton takes on the slatwall down to a handful of models. But he’s still a Newton admirer. "I love Newton’s ethos,” he says, while adding, "but that’s just one ingredient in the profit equation.

For its hiccups, Mr. Cardoso remains not just a believer, but a user. "I like the brand and I like the people,” and when he goes out on a run he’s likely to pull on a pair of Newtons.

Start the discussion at slowtwitch.northend.network